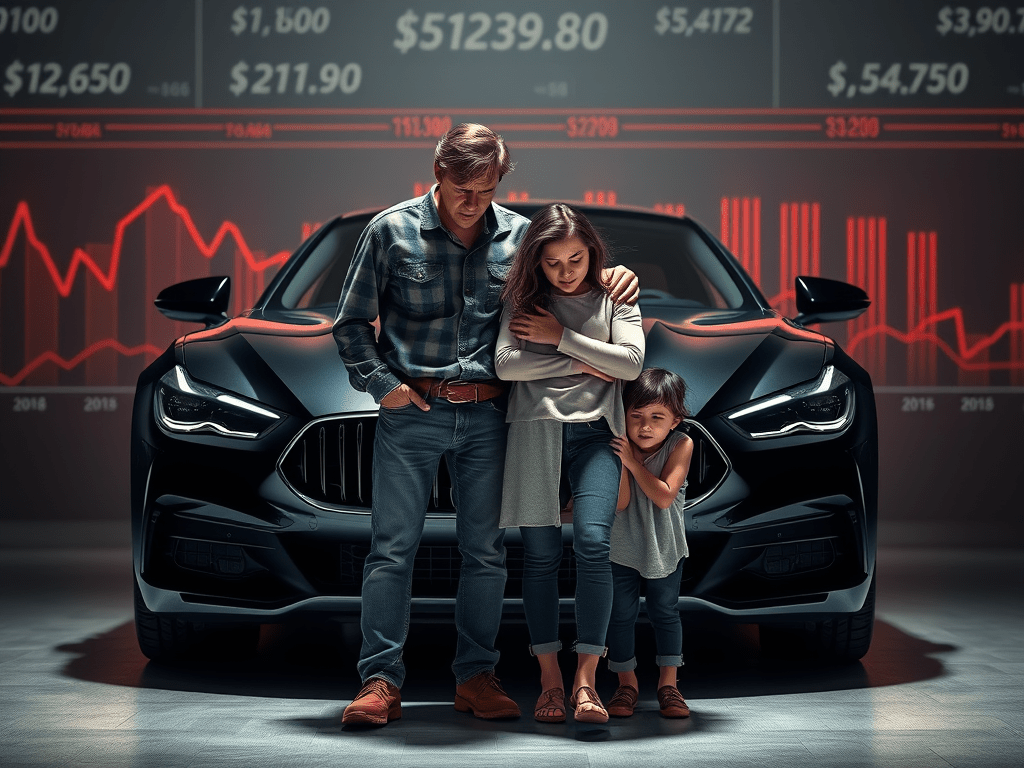

A recent report prepared by the Consumer Federation of America highlights some alarming trends for the US Auto market. According to the report, Americans owe over USD 1.66 Trillion (NZD 2.9 Trillion) in auto debt which has been accelerated by high car costs (avg. new car cost – USD 50,000/ NZD 87000) leading to affordability issues, deceptive and predatory practice by dealerships and loan sharks, scaling back of oversight and enforcement by federal regulators like CFPB and FTC, and borrowers stuck with negative equity (the depreciated value of the car is less than the money owed on it).

Some cracks in the auto industry have started to appear. Auto parts manufacturer First Brands, and sub-prime (for consumers with low credit rating) auto finance provider Tricolor Holdings have filed for bankruptcies which has got banks and the stock market spooked to some extent. According to a report on CNN, currently about 6.5% Americans are over 60 days past the due date on their auto loans.

Sources: CFA – https://consumerfed.org/reports/driven-to-default-the-economy-wide-risks-of-rising-auto-loan-delinquencies/

CNBC – https://www.cnbc.com/2025/10/13/new-car-prices-auto-loan-delinquencies.html

CNN – https://edition.cnn.com/2025/10/22/business/car-payments-late-default-subprime

Leave a comment